Description

Simplify your end-of-financial-year (EOFY) reporting process with our comprehensive EOFY Annual BAS & PAYG downloadable spreadsheet. Template in excel. *This is not a Course.

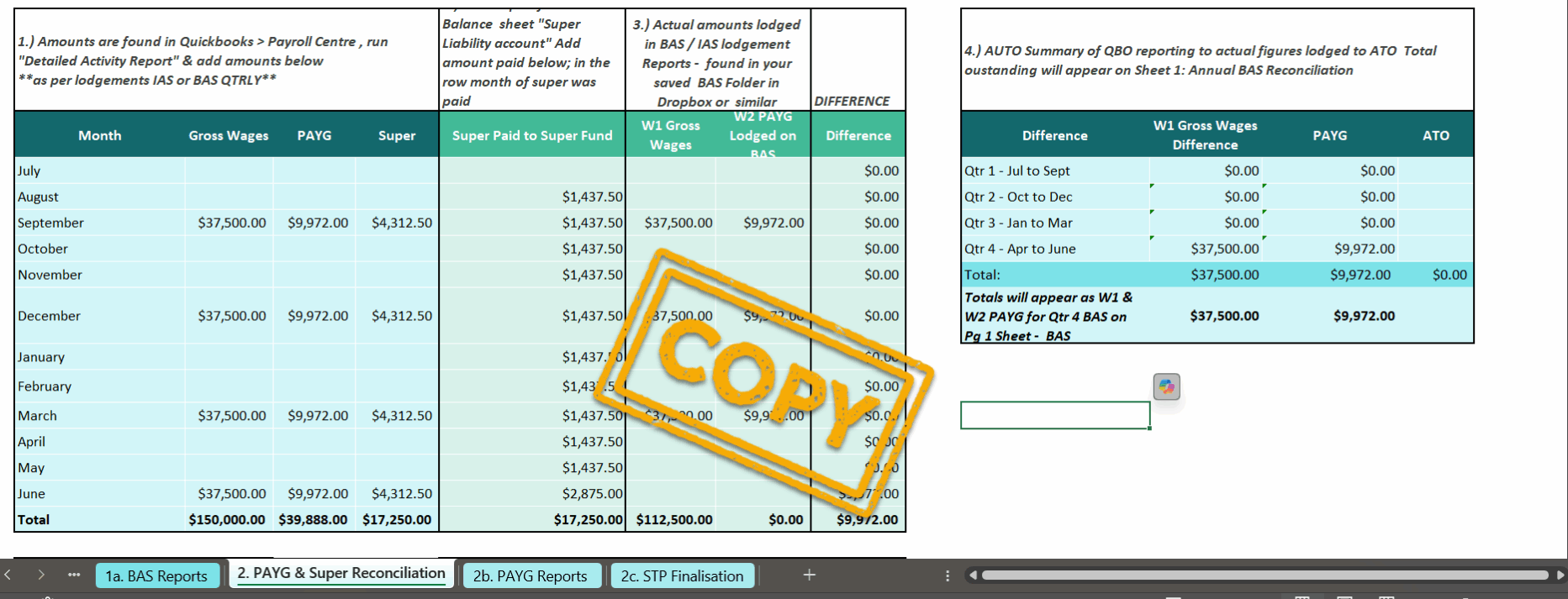

Tailored for small business owners, accountants, and bookkeepers, this Excel spreadsheet template provides a customizable template and step-by-step guidance to streamline your BAS and PAYG reconciliation for the financial year.

Overview:

The EOFY Annual BAS & PAYG Reconciliation Template Excel spreadsheet offers a pre-designed template and detailed instructions to facilitate the reconciliation process for your Business Activity Statement (BAS) and Pay-As-You-Go (PAYG) obligations. This course empowers you to efficiently organise and reconcile your financial data, ensuring compliance with Australian Taxation Office (ATO) requirements.

Key Features:

- Customizable Template: Access to an Excel or Google Sheets template.

- Step-by-Step Instructions: Detailed guidance on using the template and reconciling financial data.

- BAS Reporting: Instructions for compiling and reporting BAS information.

- PAYG Reconciliation: Guidance on reconciling PAYG withholding amounts and employee payment summaries.

- ATO Compliance: Ensure compliance with ATO requirements.

Streamline your EOFY reporting process with confidence.

There are no reviews yet.