Shop

Shop

-

Quickbooks online Support and Help

$360.00 – $1,200.00Price range: $360.00 through $1,200.00Get expert, one-on-one help with QuickBooks Online. Perfect for small business owners, bookkeepers, and accountants needing tailored support. Includes flexible sessions covering setup, reporting, payroll, and troubleshooting, plus practical strategies to boost accuracy and efficiency. Work with an award-winning QuickBooks Online professional to solve problems and improve your workflow.Select options This product has multiple variants. The options may be chosen on the product page -

QuickBooks Health Review

$380.00Get a detailed review of your QuickBooks file to catch errors, improve setup, and ensure clean, accurate data. Ideal for small businesses and bookkeepers wanting confidence in their financial records. Includes a full assessment, error check, and actionable recommendations to optimise your QuickBooks setup and ongoing processes.Add to cart -

QuickBooks Clean Up & Rescue

$360.00 – $1,200.00Price range: $360.00 through $1,200.00Fix messy QuickBooks files with expert clean-up and rescue support. Ideal for small businesses and bookkeepers dealing with errors, duplicates, or outdated data. We’ll review, correct, and organise your records—then show you how to keep them that way. Restore accuracy and confidence in your financial reporting. For best results, pair this service with the QuickBooks Health Review, which diagnoses issues upfront so your support hours are spent fixing, not searching.Select options This product has multiple variants. The options may be chosen on the product page -

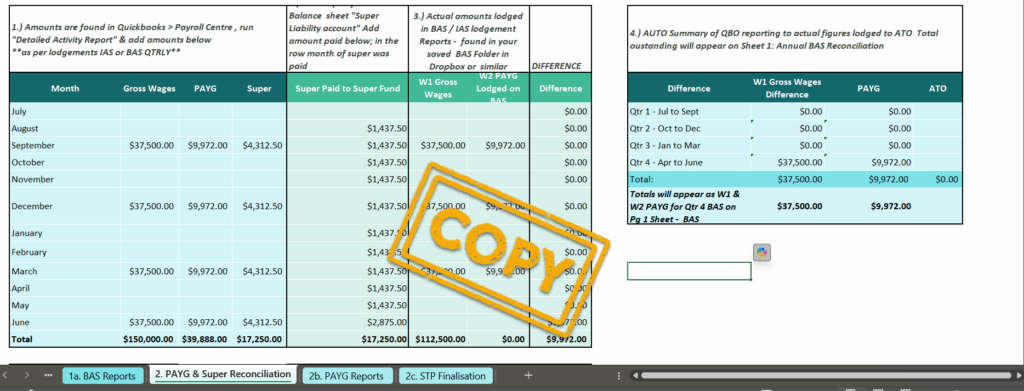

EOFY Annual BAS & PAYG Reconciliation Excel Template

$29.99Original price was: $29.99.$9.99Current price is: $9.99.Streamline your EOFY BAS and PAYG reporting with our custom Excel template. Includes step-by-step instructions to help small business owners and bookkeepers stay ATO compliant and organised. Works in Excel.Add to cart -

QuickBooks Training Services

$420.00Get personalised QuickBooks training designed for Australian small businesses. Learn the features that matter most, from setup to reporting, with practical, hands-on guidance. Whether you're new to QuickBooks or need advanced help, our sessions are tailored to your needs — delivered live via Zoom or through self-paced video lessons.Add to cart -

QuickBooks Online Payroll Setup Packages

$250.00 – $450.00Price range: $250.00 through $450.00Set up QuickBooks Online and payroll correctly from the start. Ideal for small businesses needing expert help with employee setup, pay schedules, tax settings, and compliance. Includes full QBO setup, customised payroll configuration, and professional guidance to ensure everything runs smoothly and meets ATO requirements. Package Options: Payroll setup: up to 5 Employees | Payroll setup: Up to 10 Employees | Superannuation Setup for ContractorsSelect options This product has multiple variants. The options may be chosen on the product page -

QuickBooks Online Business Setup – Starting from $550

$750.00Original price was: $750.00.$550.00Current price is: $550.00.Set up your QuickBooks Online file properly from the start. Perfect for new businesses, sole traders, and anyone moving to QuickBooks Online who wants to avoid costly mistakes. Includes complete company setup, Chart of Accounts, GST configuration, banking feeds, and custom reporting - everything you need for accurate BAS lodgements and real-time business insights.Add to cart -

Bookkeeping Mentoring Program

FreePrice on application. Enquire Now Get real-world mentoring from one of Australia’s most awarded QuickBooks experts. This program helps new and aspiring bookkeepers build the skills, confidence and practical tools they need to grow a successful business. Personalised support, hands-on training and proven strategies to help you move forward faster.Buy product -

2b) Payroll setup & Single Touch Payroll (S.T.P.) 10 Employees.

$450.00Add to cartMaster payroll setup and Single Touch Payroll (STP) reporting for businesses with up to 10 employees with our comprehensive course. Perfect for small business owners, HR managers, and payroll administrators.- Payroll Setup: Detailed instructions for setting up payroll.

- STP Compliance: Understanding and meeting STP reporting requirements.

- Employee Management: Adding and managing employee details for a team of 10.

- Tax Withholding: Calculating and withholding taxes accurately.

- STP Reporting: Generating and submitting STP reports to the ATO.